在美国买卖投资房,需不需要交税?

最近美国的房地产非常火热,好多人想买房子都买不到,有时候一处房产,有超过70个买家去抢,最后得手的,要高出要价的百分之二、三十,而且是现金才能买得到。那在美国买卖房子需不需要缴税呢?答案是,要也不要,看你是怎么操作的。在美国,所有的所得都要缴税,如果你卖了房子之后,不打算再投资,特殊免税额之外的部分就要交资本利得税,这在联邦税率最高是20%。不过,在美国有一个法规,对这些投资房地产的投资人来说,特别的好用,那就是税法的1031条款。

比方说,你今天有个房地产,非自住,而是投资的房地产。买了以后赚了钱,把它卖掉以后不想交税,有可能吗?有的。你可以在45天之内去找另外一个价格相同或更高的同类房地产,并且能在180天之内完成交易的话,你当前就不用交税。这个税不是永远不交,而是可以无限后延。

假设十年前你买这个房子是20万,现在价值100万,你要现在卖掉,会有80万的资本利得。这个80万的资本利得,你要付20%的联邦的资本利得税,如果还有州税,像加州的话,最高是13.3%。联邦还有一个另外的附加税是3.8%,加起来就相当可观了。如果不想交这个税,可不可以,可以!卖价100万,你收到以后,要用它再去买一个100万或以上的投资房产。这包括你投资商店、土地,都可以,只要是投资的物业,资本利得就可以无限的往后延。但是一定记得,要先物色、确定好这个产业,并在180天之内把它“拿下”。 美国有很多有钱人就是靠1031不断地做这个交换来避税。

因为没有卖出产业,所以没有产生资本利得税,但人走以后,这个市价就会变成业主遗产的一部分,这个时候就要来算遗产税。那遗产税我们怎么规避?遗产规划需要趁早、合理做,有一些方法可以达到规避遗产税的目的。其中一个最有效的,是尽早拥有一个人寿保险,来达成合理的减免。

01

今日三大指数下跌,标普500下呹1.9%,道琼工业指数下跌1.3%,纳斯达克综合指数下跌2.72%,标普500及纳斯达克综合指数创下2020年三月以来最大单周跌幅。消费者必需品是标普500唯一收正的版块,上涨0.1%。

02

之前得益于疫情的居家概念股如Netflix及Peloton在疫情逐渐缓和的情况下前景充满不确定性,Netflix今日下跌22%,Peloton则是上涨12%,部分抵销昨日该公司将暂停生产的负面消息造成的24%下跌。

03

虽然市场表现不佳,但投资人目前对市场并未过度乐观,应该正面看待。建议可以部分调整持仓部分,避免因恐慌心态抛售,待市场反弹时再进行大规模调整。

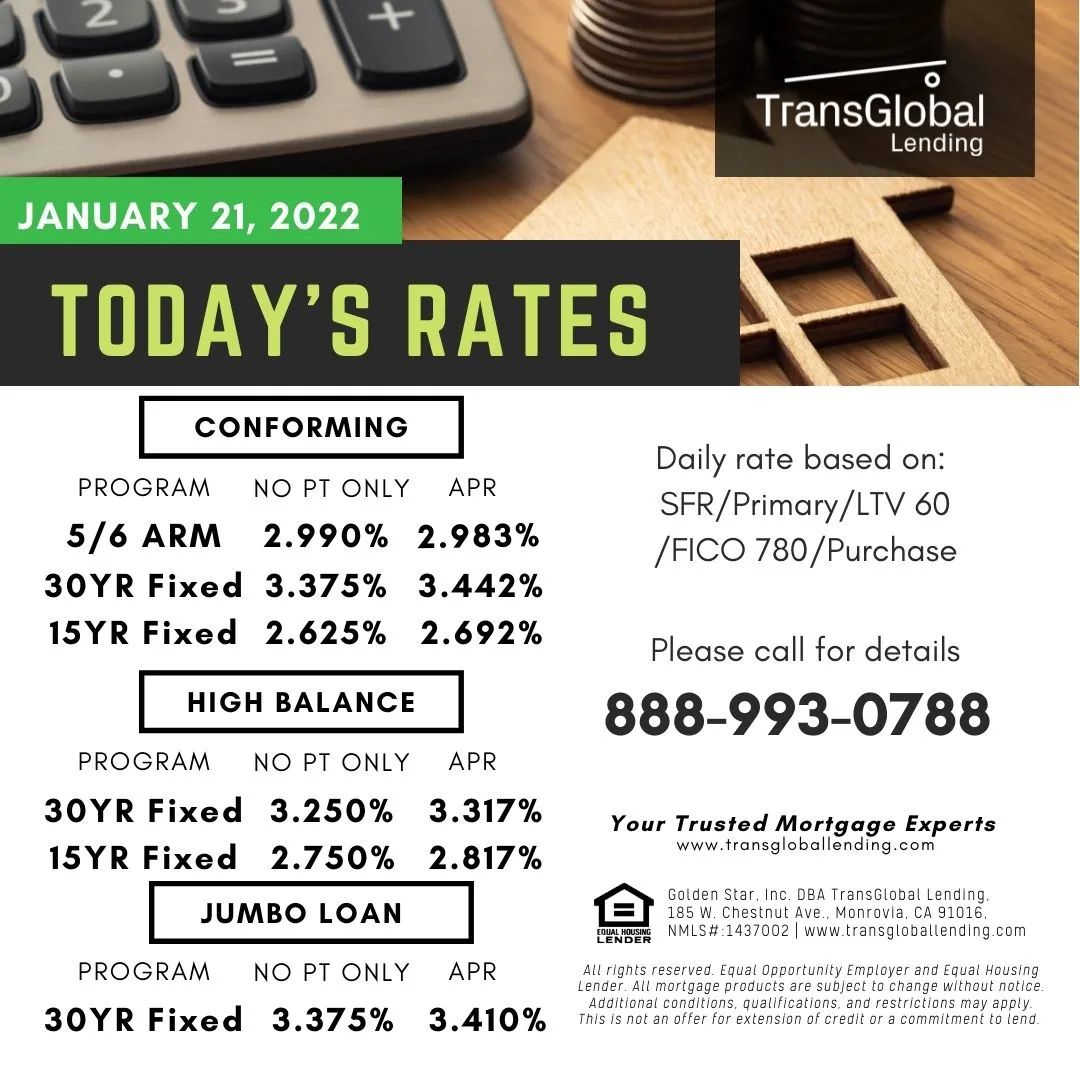

IMPORTANT: Advertised rates were valid and effective as of the date reflected above, are for informational purposes only, and are subject to change without notice.

Loans are subject to credit and collateral approval. Advertised rates are based on a set of loan assumptions including a borrower with excellent credit history and optimal loan characteristics. Your final interest rate and annual percentage rate (APR) may differ depending on your individual transaction's specific characteristics, and certain products may not be available for your situation. Several determining factors include, but are not limited to, the state of the property location, loan amount, documentation type, loan type, occupancy type, property type, loan to value, and credit score.

APR reflects the cost of credit over the term of the loan expressed as an annual rate. For mortgage loans, APR may include the interest rate, discount points (also referred to as "points"), and other charges or fees (such as mortgage insurance and origination fees), but does not necessarily take into account other loan-specific finance charges you may be required to pay.

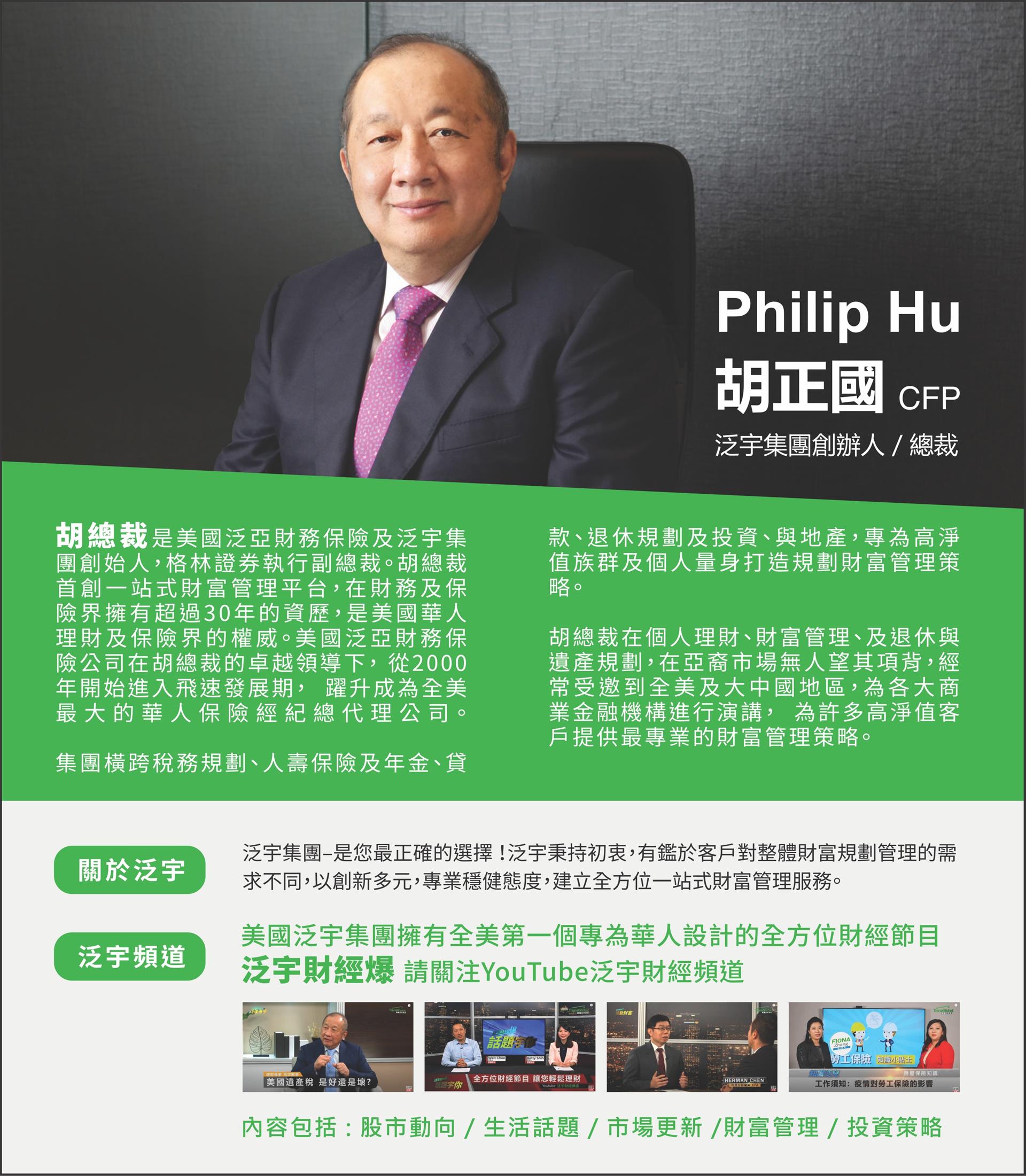

Investment securities products and services are offered through Globalink Securities, Inc. (GSI) and TransGlobal Advisory, LLC. (TGA). GSI is member of FINRA & SIPC, which is a separate registered broker-dealers and non-bank affiliates of TransGlobal Holding Company. Portfolio management and advisory services are provided by TGA, a registered investment advisor and subsidiary of TransGlobal Holding Company.

Investment and brokerage products are:

Not FDIC Insured • No Bank Guarantee • May Lose Value

关注我们

微信号|FanyuUSA

新浪微博|泛宇一站式大讲台

图片翻摄自网路,版权归原作者所有。如有侵权请联系我们,我们将及时处理。

登錄

登錄